Why choose a Building Society or Credit Union over a bank?

Building Societies & Credit Unions are different because…

We reinvest our profits, so you get better rates.

We don’t pay out to external shareholders, because we don’t have any.

We’re owned by you, so it’s you we’re working for.

We value you as an individual.

We take pride in treating you fairly.

We’re genuinely committed to supporting communities.

We’re keeping branches open, and we’re opening more.

We’re purpose driven, and we are truly sustainable.

We’ve got 250 years doing the right thing.

Unlike banks who…

Prioritise making as much profit as possible.

Pay dividends to their external shareholders.

Don’t offer the same long-term value to customers.

Close branches and abandon high streets.

Proudly different

The numbers add up…

£6.7bn

more interest

paid to

savers.*

497k

mortgages to

first-time buyers

in five years.**

30%

share of high street

branches, up from

14% in 2012.

93%

of customers say

we provide good

customer service.

93%

of customers say

they would

recommend us.

72%

of customers said

we are an important

part of the

community.

*compared to the average savings rates offered by the largest banks in the five years to September 2024

**in the five years to September 2024

Find a better place for your money

Is it time you considered a Building Society or Credit Union?

The original money movement

Building societies since 1775

Building Societies have been part of our communities for 250 years.

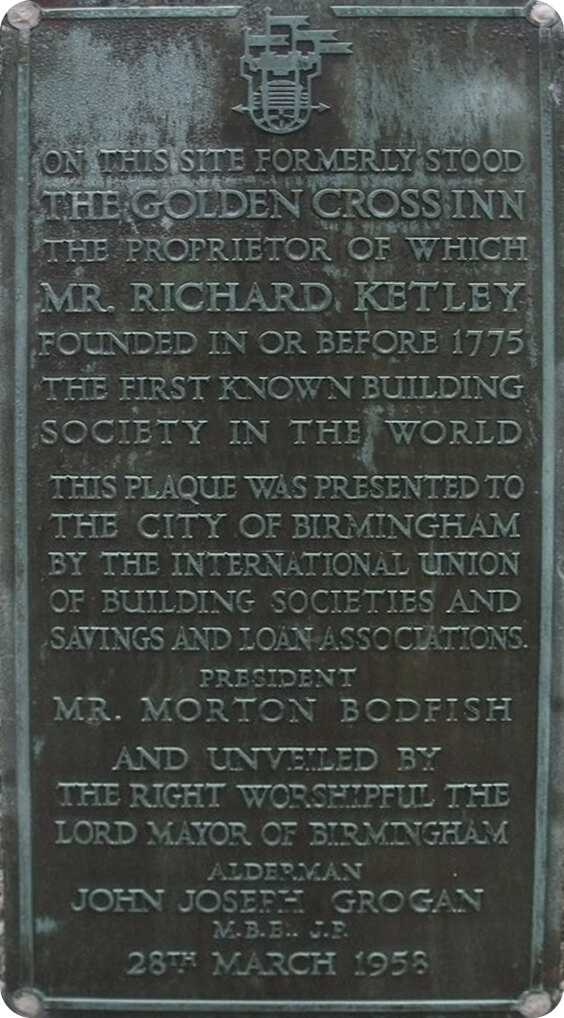

In 1775, Richard Ketley, the landlord of the Golden Cross Inn in Birmingham, got his regulars to pool their savings each week. When there was enough money in the pot, they used it to buy land and build a home. They drew lots to determine which of them would get the home. They all carried on saving and building houses until each member owned their own home. Ketley’s Building Society was the first ever Building Society.

There are 42 Building Societies in the UK today, with over 25 million members, more than 1,300 branches on our high streets and they employ around 52,500 people.

Credit Unions are member-cooperatives, providing savings and loans to these members who all share a common bond. This typically means they are either based in their local community or their members work in the same sector, e.g. the police. Credit Unions promote regular saving, offer personal loans and some also provide mortgages. Their members’ needs are at the heart of their business. The first Credit Unions in the UK started in the 1960s, often founded by recent immigrants with experience of Credit Unions in both the West Indies and Ireland.

Building Societies and Credit Unions are still owned and run for the benefit of their members, the customers, and all profits are reinvested back into the business, which is reflected in their rates, products and services.

Genuinely committed to supporting communities

From charity fundraising to community projects, read how Building Societies & Credit Unions work with their communities.

All together, for each other

The Building Societies Association

The Building Societies Association (BSA) was established in 1869. It is the voice for all 42 UK building societies, including both mutual banks, and 7 of the largest Credit Unions.